SFDR

: Sustainability-related disclosuresForeword

The EU’s Sustainable Finance Disclosure Regulatory (SFDR) also called Taxonomy Regulation is a classification system, establishing a list of environmentally sustainable economic activities. It could play an important role helping the EU scale up sustainable investment and implement the European green deal. The EU taxonomy would provide companies, investors and policymakers with appropriate definitions for which economic activities can be considered environmentally sustainable. In this way, it should create security for investors, protect private investors from greenwashing, help companies to become more climate-friendly, mitigate market fragmentation and help shift investments where they are most needed.

The Taxonomy Regulation establishes six environmental objectives

- Climate change mitigation

- Climate change adaptation

- The sustainable use and protection of water and marine resources

- The transition to a circular economy

- Pollution prevention and control

- The protection and restoration of biodiversity and ecosystems

- Different means can be required for an activity to make a substantial contribution to each objective.

Solar World Invest Fund SIF (hereafter SWIF) is requested to document its policy on integrating sustainability in its investment decisions and describe how this is achieved. The policy shall be reviewed and approved annually by the management of SWIF.

A. Summary

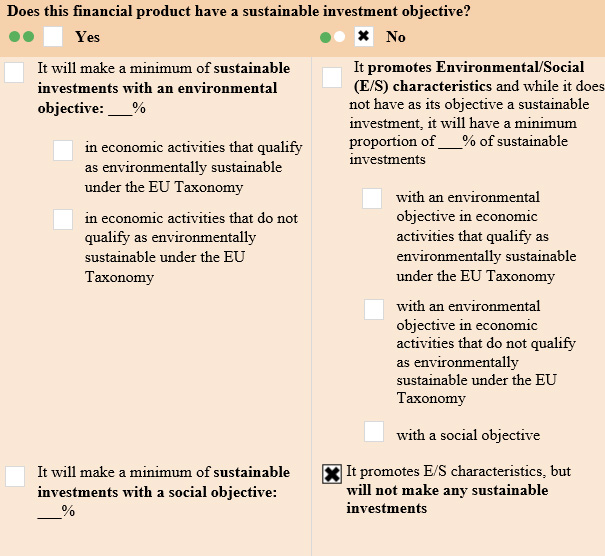

SWIF has been classified as a fund which promotes environmental and/or social characteristics under Article 8 of SFDR. SWIF investment strategy consists in investing exclusively in renewable energy electricity generation projects which contribute to the gradual decarbonization of the global electricity energy sector. Projects require material construction and capital expenditures in order to be completed and thus may require a certain component of labour, which may in turn generate social and economic opportunity and positive social externalities.

SWIF promotes environmental or social characteristics but does not have as its objective sustainable investment and does not commit to a minimum share of investments in sustainable investments aligned with the Taxonomy Regulation. Through the promotion of environmental or social characteristics, SWIF intends to limit exposure to sustainable risks. To that aim, SWIF has implemented as from 1st January 2022 an SFDR aligned ESG strategy in which SWIF applies i.a. a positive and a negative screening as described hereinafter.

These non-financial criteria are integrated into the investment process to all other criteria during the pre-investment and due diligence phase of the investment decision process through the implementation of the sustainability approaches in selecting target investee companies.

SWIF is responsible for collecting, processing and monitoring sustainability-related data which monitoring is facilitated by a majority ownership of the portfolio companies.

Sustainability-related data comes predominantly from publicly available sources, communications with any parties involved in the investment, and third parties specialising in ESG data provision (as appropriate). Data may be subject to limitations. SWIF does not use engagement strategies to incentivise parties involved in an investment to improve their ESG risk but any ESG alignment is facilitated by a majority ownership of the investee companies.

SWIF does not use benchmarks to assess its environmental or social performance but use different indicators to assess such performance.

B. No Sustainable Investment Objective

SWIF promotes environmental or social characteristics but does not have as its objective sustainable investment.

C. Environmental or social characteristics of SWIF

SWIF promotes certain minimum environmental and social safeguards by primarily applying exclusion criteria since 1st January 2022 with regards to products and business practices that it considers detrimental to the environment or to the society in general (the fund’s exclusion list):

- Norm-based screening:

- Companies severely breaching the UN Global Compact principles or OECD Guidelines for Multinational Enterprises;

- Exclusion screening:

- Companies that have high levels of CO2 emissions;

- Companies that have fossil fuel based energy activities;

- Companies that have a damaging impact on biodiversity;

- Companies involved in water pollution;

- Companies involved in tobacco, controversial weapons and thermal coal sectors.

D. Investment strategy

SWIF investment strategy consists in investing exclusively in renewable energy electricity generation projects which contribute to the gradual decarbonization of the global electricity energy sector. Projects require material construction and capital expenditures in order to be completed and thus may require a certain component of labour, which may in turn generate social and economic opportunity and positive social externalities.

Since 1st January 2022, the General Partner applies on a continuous basis the fund’s exclusion list and its risk management methodology to determine the eligibility of companies for SWIF, but the ESG criteria promoted within the meaning of the SFDR, contribute to, but are not a determining factor in the decision-making.

Since 1st January 2022, the General Partner applies on continuous basis ESG integration and a risk management methodology to determine the eligibility of companies for the Sub-Fund, but the ESG criteria within the meaning of the SFDR contribute to, but are not a determining factor in the decision-making.

Since 1st January 2022, SWIF has integrated non-financial criteria to all other criteria during the pre-investment and due diligence phase of its investment decision processes through the implementation of two sustainability approaches in selecting an investee company:

- Positive screening: selection criteria including for instance:

- investing in the renewable energy sector;

- investing in clean energy consisting in photovoltaic energy production facilities with a focus on solar photovoltaics installations;

- investing in "project companies":

- that operate existing renewable energy power plants or newly developed plants/installations at “financial close" being well developed projects with the use of proven technologies, solid project contracts, adequate insurance cover, qualified management of the project and availability of irrevocable required permits and licenses, power purchase agreement, grid connection, solid cash flow projection and project financing in place to the benefit of the Fund;

- that have low levels of CO2 emissions;

- which may be offering energy-storage projects;

- that exhibit positive ‘energy transition’ characteristics (i.e., by supporting the decarbonization of electricity production). Accordingly, the following environmental characteristics are de facto taken into account: climate change mitigation; reduction of CO2 gas emissions; renewable energy, although SWIF does not commit to invest in sustainable investments within the meaning of the SFDR and does not take into account the EU criteria for environmentally sustainable economic activities of the Taxonomy Regulation when investing.

- Negative screening (bottom-up) via norm-based and exclusion screening: SWIF portfolio complies with the exclusion list, that is based on exclusion criteria with regards to products and business practices that SWIF believes are detrimental to society and incompatible with sustainable investment strategies. This means that SWIF has, in principle, 0% exposure to excluded investments, taking into account the best interest of SWIF shareholders and/or a grace period or unless a reliable remediation/transition plan is accepted.

- Negative screening (bottom-up) via norm-based and exclusion screening: SWIF portfolio complies with Sub-Fund's exclusion list, that is based on exclusion criteria with regards to products and business practices that SWIF believes are detrimental to society and incompatible with sustainable investment strategies. This means that SWIF has, in principle, 0% exposure to excluded investments, taking into account taking into account the best interest of SWIF shareholders and/or a grace period or unless a reliable remediation/transition plan is accepted.

- Monitoring: After investment, the projects and SPVs are monitored to ensure the implementation of recommendations (if any) arising during the investment acquisition process. The data sourcing and reporting to the Board of the Fund relies on contractors involved in the construction phase or in the O&M (Operation & Maintenance) of the photovoltaic plants owned by the SPVs. The monitoring process is facilitated by majority ownership of the "SPV’s".

SWIF does not commit to assess good governance practices of the investee companies within the meaning of the Taxonomy Regulation, although depending upon the financing requirements for a new target company it must potentially comply other social and environmental criteria: assessment and management of environmental and social risks and impacts; labor and working conditions; resource efficiency and pollution prevention and control; health, safety and security; land acquisition, restrictions on land use and involuntary resettlement; biodiversity conservation and sustainable management of living natural resources; indigenous peoples; cultural heritage; financial intermediaries; information disclosure and stakeholder engagement.

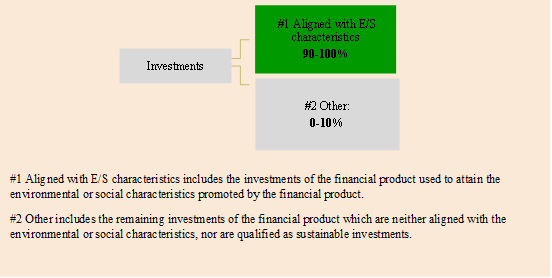

E. Proportion of Investments

SWIF screens all its investments against the fund's exclusion list, apart from cash, cash equivalent and derivatives (if any):

#1 investments (i.e. those aligned with E/S characteristics) comprise all investments that are screened against the fund's exclusion list.

#2 investments are those investments that are not screened against the fund's exclusion list.

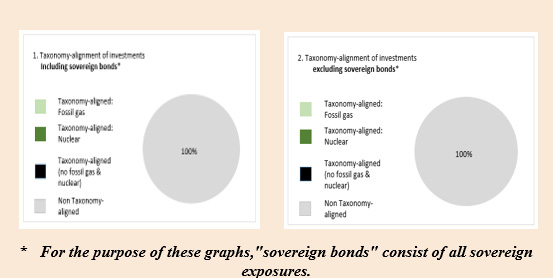

The EU Taxonomy is not taken into account in the management of SWIF and as such fund’s investments do not take into account the criteria for environmentally sustainable economic activities under the EU Taxonomy.

F. Monitoring of environmental or social characteristics

To ensure that environmental and social characteristics are met throughout the lifecycle of SWIF, the fund’s exclusion list is applied and monitored since 1st January 2022 on an ongoing basis with a regularity in line with the calculation of its net assets value. In case an investee company no longer meets this requirement, the investee company will be excluded from the potential investment universe, subject to any, i.a. a grace period or unless a reliable transition plan is accepted and taking into account the best interest of SWIF shareholders.

G. Methodologies

The methodology to measure how the social or environmental characteristics promoted are met relies on the percentage of investment in companies that are on the fund’s exclusion list taking into account the following:

- "Adherence UN Global Compact principles or OECD Guidelines for Multinational Enterprises": SWIF promotes adherence to, and the conducting of business activities in accordance with, the UN Global Compact principles or OECD Guidelines for Multinational Enterprises by scrutinizing companies that violate these principles. Measurement is based on the number of companies breaching the fund’s exclusion. Measurement is based on the number of companies excluded as a result of SWIF exclusion.

- "Reduction of CO2 emissions": SWIF promotes the reduction of CO2 emissions by investing itself in energy generation facilities from renewable sources. As a result, the green energy produced helps to reduce CO2 emissions.

- "Reduction of fossil fuel-based energy activities": SWIF promotes the reduction of fossil fuel-based energy activities by investing itself in energy generation facilities from renewable sources. As a result, the green energy produced leads to reduction of fossil fuel-based energy activities. Measurement is based on the number of companies breaching the fund’s exclusion.

- Reduction of damaging impact on biodiversity": SWIF promotes the reduction of damaging impact on biodiversity by evaluating and assessing environmental characteristics of each investment project through an Environmental Impact Assessment including flora and fauna and biodiversity impact studies). Measurement is based on the number of companies breaching the fund’s exclusion.

- Reduction of water pollution": SWIF promotes the reduction of water pollution because its investments do not generate any water pollution. Measurement is based on the number of companies breaching the fund’s exclusion.

- "Reduction of involvement in tobacco, controversial weapons and thermal coal sectors": SWIF promotes the reduction of involvement in tobacco, controversial weapons and thermal coal sectors by prohibiting any investment with involved in these sectors. Measurement is based on the number of companies breaching the fund’s exclusion.

H. Data sources and processing

As data sources, SWIF employs a combination of researches, news, information gathered through due diligences on companies and data from external providers, third-parties contractors/ consultants providing Environmental Impact Assessments (including technical project specifications, generation capacity and forecasted renewable energy generation as well as topological and geographical technical surveys, where relevant, flora and fauna technical and biodiversity impact studies). The Environmental Impact Assessments are comprised in the initial due diligences and are documented in an investment memorandum or similar.

In some instances, information and data, which may be incomplete, inaccurate or unavailable. Accordingly, a certain proportion of data may be estimated on a case-by-case basis depending upon the findings and data available with respect to a given company from the Environmental Impact Assessments.

I. Limitations of Methodologies and Data

As criteria, the methodology includes both legally binding classifications and measures implemented by the company on a voluntary basis to increase its own sustainability. While the legal classification of a company (or an investment) can be observed relatively easily and is regulated relatively precisely by the legislator, those voluntarily implemented to pursue good corporate governance are more difficult to observe and evaluate. Also, there may be data coverage issues and different methodologies used by external data providers. It is not expected that such limitations would affect how the social characteristics promoted by SWIF are met to the extent SWIF does not commit to assess good governance practices of the investee companies within the meaning of the Taxonomy Regulation. That said, obtaining sustainability-related data is generally facilitated by a majority ownership of the investee companies.

J. Due Diligence

Before acquisition of any target investee companies, a due diligence is always performed by external advisors. This due diligence process assesses the quality of each contemplated company and tries to rule out that investments are done with companies where it can be reasonably assumed that the fund’s exclusion list (internal control consists i.a. in yearly declarations) is violated and the following aspects are reviewed from a legal and technical point of view by third parties experts: LEGAL

- CORPORATE STRUCTURE OF THE SPV: brief Corporate History, Charter, management of the company,etc.

- REAL ESTATE AND LAND ISSUES: Land Plots Allocation and Classification, Land Lease Agreement, Cadastre, Soil Removal Issues, etc.

- CONSTRUCTION AND GENERAL DESCRIPTION OF THE PROJECT: Project Design and town-Planning Restrictions; Initial Detailed Plan of Territory; Design and Survey Works; Construction Permit; Grid Connection Agreement; Environmental Issues

- ENVIRONMENTAL ISSUES: Including Environmental Impact Assessment Report

TECHNICAL

- SITE CONDITIONS AND SITE STUDY: Site Location and Climate, Land Characteristics, Available Infrastructure for grid connection

- REVIEW OF PROJECT DESIGN: Plant Layout, MV Design, Civil Works, …

- TRANSMISSION AND INTERCONNECTION: Interconnection and power transmission, Grid Connection Review

- TECHNOLOGY REVIEW: PV modules, Inverters, Transformers, Mounting structures, Monitoring System, Security System

- ENERGY YIELD ESTIMATION: Including Long Term Modelling and Estimation of Losses

- REVIEW OF EPC AND O&M CONTRACTS

The due diligence process also includes:

- savings in terms of CO₂ produced,

- preference to utilize, for the installation of power plants, low grade agricultural land, preferably not used for agricultural purposes, no hampering ecosystems and in underdeveloped social areas,

- selection of key suppliers (seller of the project developer, landlord, photovoltaic and inverter suppliers and engineering procurement contractors) after duly consider their track records. Contractual agreements are structured in order to ensure, at construction and operational phases, full compliance with applicable undertakings and forecasts.

Before construction and installation works, a comprehensive assessment of the Environmental Impact Assessments usually assesses that:

- performance of the specified works is provided according to requirements of construction norms and rules;

- pollution of soil, surface and groundwater is excluded;

- excluded impact on the geological environment at the expense of the provided design decisions in accordance with the data of geological surveys;

- excluded acoustic discomfort in the area of residential buildings;

- construction waste and waste generated during construction are removed;

- in the area of the projected power plant, there are no territories that belong to the nature reserve fund, as well as areas promising for creation of reserves, so the planned activities will not have a significant impact on flora and fauna of the surrounding areas;

- due to the above measures, the effect of construction and installation works on the man-made environment, as well as on the living conditions of the population in the specified area is expected within acceptable limits;

- no unforeseen consequences in the field of ecology are expected, no damage to the environment is forecasted.

K. Engagement Policies

Engagement policies aligned with SFDR and the Taxonomy Regulation are not part of the environmental or social strategy as such.

L. Reference benchmark

SWIF has not defined a benchmark with regards of attaining the sustainability characteristics.

****************

January 2023